Developing a full-funnel PPC strategy is essential for long term growth. While it’s clearly important to maximise lower-funnel demand, a blinkered approach will impact long term growth and lead to market share decline in the longer term.

Here I’ll explain how to effectively diversify your ad spend based on a tried and tested research framework that will help identify areas worth investing in at every stage of the funnel and drive sustainable, long-term growth.

Recognising the foundations needed for PPC success

It doesn’t take a rocket scientist to work out that creative elements such as well considered UX, clear brand messaging, and investment in CRO will improve the overall effectiveness of PPC campaigns.

It’s also essential that you cover the foundational elements needed to build your strategy such as market research, audience research and in-depth brand and competitor analysis, before moving on to launch PPC activity.

Having a solid understanding of who you should be targeting, which networks will prove most effective and where your competition are spending their advertising budget is key to developing a winning strategy.

Our research and analysis framework

We’ve developed a reusable framework for developing our understanding on any brand, which then feeds our PPC targeting strategy.

By carrying out research using the questions in the table below, you will uncover trends to factor into your PPC strategy that will improve the overall effectiveness of your campaigns.

Examples

To bring the theory to life I’ll now run through a few examples of the type of information you can uncover using this framework, before moving on to detail how this can be used to develop a full-funnel PPC strategy.

We’re going to focus these examples on a financial services client to highlight how research can help uncover opportunities to generate results even in the most expensive PPC verticals.

Uncovering audience groups most likely to convert

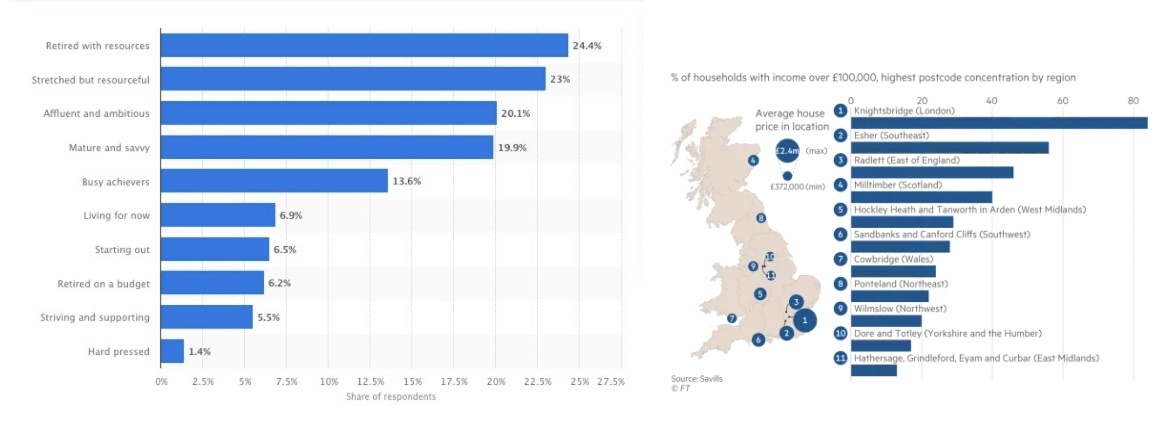

A lot of the stats I’m going to run through are gathered using numerous either free or relatively low cost research tools. This particular example is pulled from the research database Statista.

Working with an investment client, we firstly wanted to uncover data on the audience types most likely to be interested in this product. This is broken down further by age and average annual household income, which we were then able to expand using publicly accessible data from the ONS.

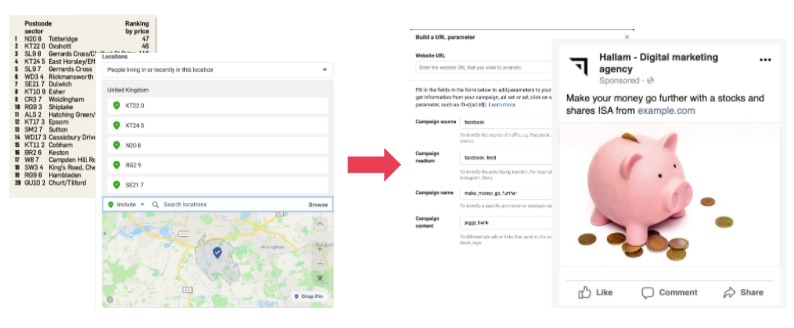

We were then able to export a list of the postcodes that have the highest population density of people with household incomes of over £100k in the UK.

We can of course blend both of these data sets in our PPC targeting to reach a highly relevant audience for this brand, which I’ll go on to cover later in this post.

Identifying factors that influence conversion decisions

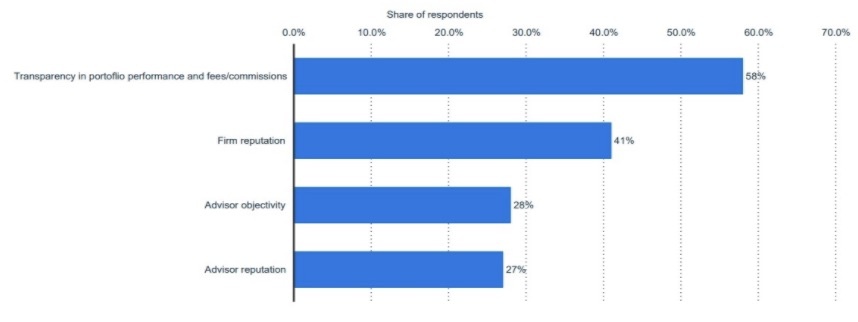

Moving on, we wanted to look into the factors that influence decision making specifically around investments, which we could factor in to our creative.

We sourced data that highlighted trust and transparency were particularly important factors influencing decision making in the investment space.

Based on this, it was clearly important to showcase trust and transparency through the campaigns we were running. For example, using trust signals in our landing page content, writing and promoting informative guides to build trust and credibility, along with transparency on rates and fees, all of which will result in a higher conversion rate.

Researching the questions your audience are asking

We now know that building trust is important in the investment space, add to this with the fact that financial services is the third most expensive industry for Google search advertising, and it was clear that we needed to look for other opportunities to gain visibility in this space.

Rather than focusing our entire budget on targeting transactional keywords, we needed to fish further upstream and target informational keywords to try and build trust and drive product consideration.

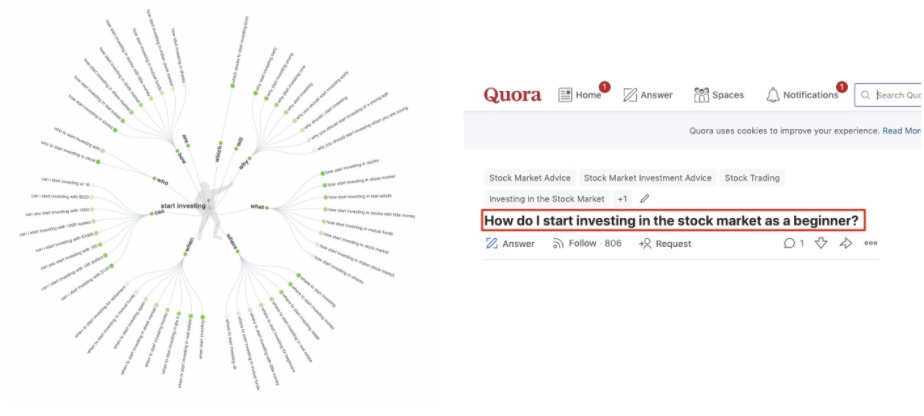

To do this, we firstly used Answer the public to get a list of the questions potential customers were asking around investment in the early stages of their research.

We then looked to research the cost of advertising for these keywords in Google search, as well as identifying alternative advertising networks such as Quora to target these questions where we could potentially get cheaper visibility and clicks – more on that later in this post.

Review brand awareness trends vs. competitors

Encouraging brands with smaller budgets to invest in brand awareness campaigns is often challenging due to the lack of immediate return when compared with bottom-funnel tactics.

One way of proving the value of brand building is showcasing how investing in upper funnel advertising such as display and video campaigns can have a positive impact on organic brand search interest.

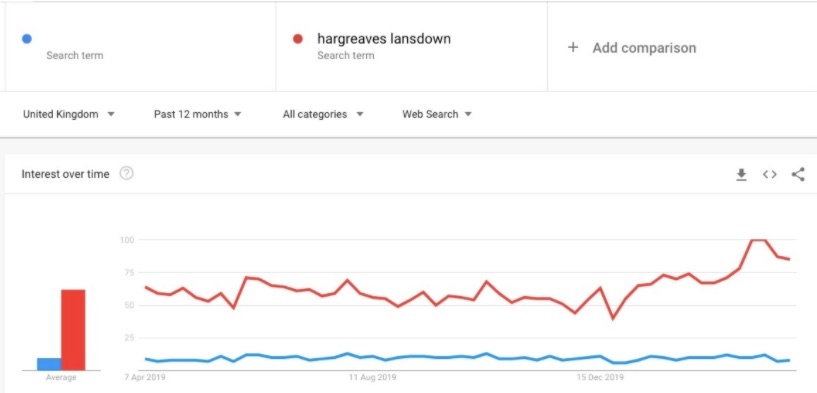

In this example, we used Google trends to look into how demand may be changing over time for our clients brand, and compared that with a competitor they identified.

You can see here that our client (blue line) has had no notable increase in brand interest for the past year, whereas the competitor in question (red line) has had a huge spike in brand interest which began in January 2020. We were then able to explain how exactly they may be driving this growth in brand interest.

Find out how your competitors are driving their growth

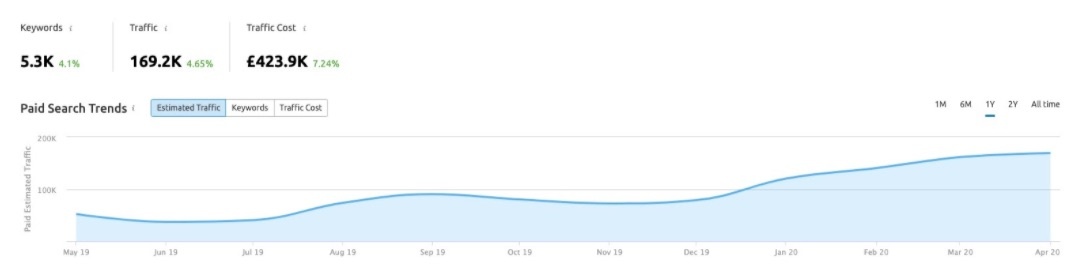

Using SEMrush advertising research tools you can get a good estimate of how much your competitors are investing in paid advertising.

In the case we’ve just highlighted, we can see that the competitor in question has really increased their investment in PPC since the turn of the year, which has clearly had a positive impact on their brand recognition.

We also reviewed the different ad types their competitor had been leaning on and noted that display and video had been used extensively in their campaigns.

Review the creative messaging your competitors are using

Using MOAT, you can identify the creative assets being used by your competition in their advertising campaigns.

In this case we’d already noticed that Hargreaves Lansdown have invested heavily in display advertising since the turn of the year, so we wanted to check out the creative they’d been running to help inform our own strategy.

How to turn your research into a strategy

Let’s start here by summarising the key pillars we identified in our research examples above:

-

- If we focus on search alone in a competitive industry, we will burn through our budget too quickly so we must diversify our advertising spend

- Our brand awareness is low in comparison to competition who are ramping up display spend – we must invest in upper-funnel advertising

- There are opportunities to target relevant keywords in the consideration phase through targeted advertising on Quora

- We know that audience members close to retirement in certain locations are more likely to convert and they must be targeted specifically

These points are further backed by some general statistics we use to guide our approach for all clients.

Firstly, the need to expand your approach beyond search ads. According to research from the IPA, focusing on search alone is only going to give you visibility for roughly 7% of the time your potential customers spend online.

Secondly I wanted to share some research from Wordstream on the positive impact of cross-network advertising on branded search.

You can see here that the more networks used, the greater the uplift on brand search demand – another reason why having a cross network approach would be beneficial.

Developing a full-funnel PPC strategy

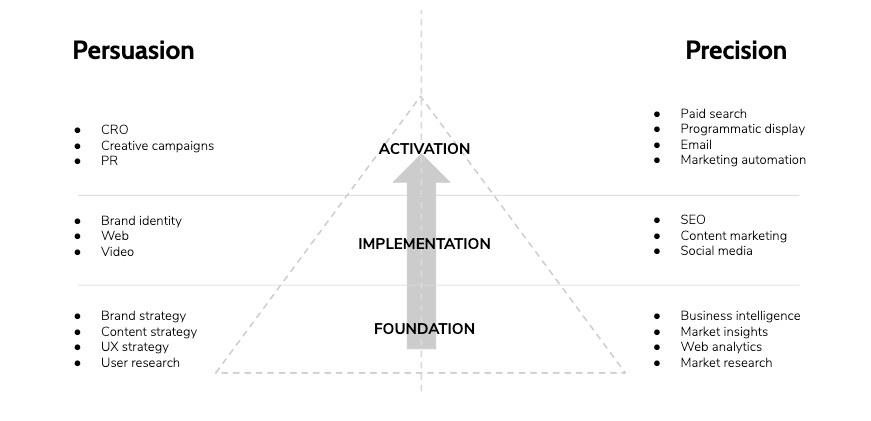

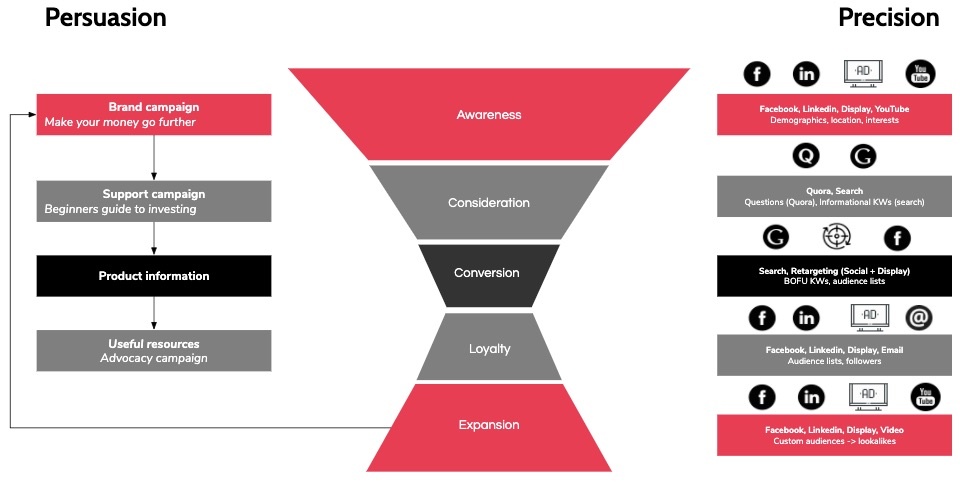

Now clearly there’s more detail behind this such as specific budgets, keywords, placements etc. but what we aim to do for all clients is detail on one page how they can utilise different networks at each stage of the funnel.

And because it’s important not just to focus on targeting, we’ve highlighted here the persuasion element, in this case the different content we’re going to utilise alongside our ads at each stage of the funnel.

To help bring this to life I’m now going to walk through a step by step overview of some of the tactics we used as part of this strategy at each stage of the funnel.

Awareness

To build awareness, we need to associate our clients brand with useful content that may help raise awareness of the products and services they offer.

At this stage we chose to focus on promoting guides and informational content and get our brand in front of people who aren’t looking for our service right now, and try and encourage interest.

Facebook ads were used here due to the vastly superior demographic targeting options when compared to Google Ads. Although you can use location targeting on many networks, the combination of location targeting with detailed demographic information such as age, and interests makes this an effective platform for targeting specific audience groups early on.

At this stage we were able to target the locations in the UK we’d uncovered with the highest disposable income, and also defined and layered age targeting around those groups we identified earlier who are most likely to be interested in investments.

Consideration

At this stage the people we’re trying to reach will be exhibiting some behaviours that indicate an interest in the products and services were able to offer.

An example here is people searching for information related to the products, but not the products themselves – in this case people searching for investment advice.

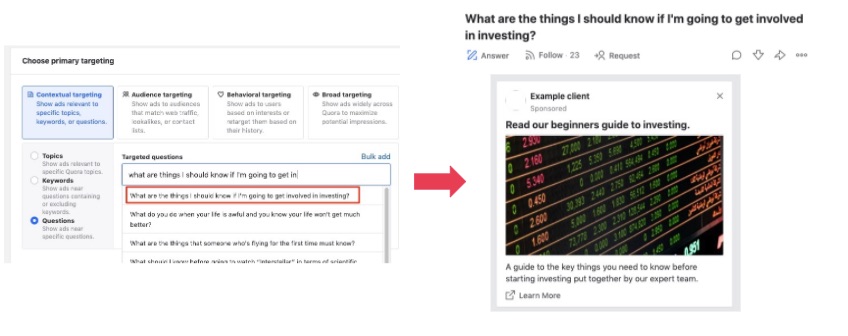

We found Quora a useful platform to use at this stage. Quora has hundreds of questions and thousands of users interested investment topics which we were able to target with ads.

Quora allows you to target a highly relevant group of people who are actively researching questions about products or services you sell, much like Google search, but at a fraction of the cost.

As an example, typical CPCs on Quora in financial services ranged from £0.50 – 0.80 pence, which are clearly great CPCs for such an expensive vertical.

This doesn’t mean you should give up on Google, Linkedin, Facebook – far from it – Quora is just another avenue to explore, and in competitive verticals it’s important to look to other channels to enable you to compete for visibility.

Conversion

At this stage we’re trying to make the most of a very small ad spend in a highly competitive (expensive) stage of the funnel.

Search ads can be expensive, and if you have smaller budgets you might not be able to achieve the return you want without layering additional targeting options.

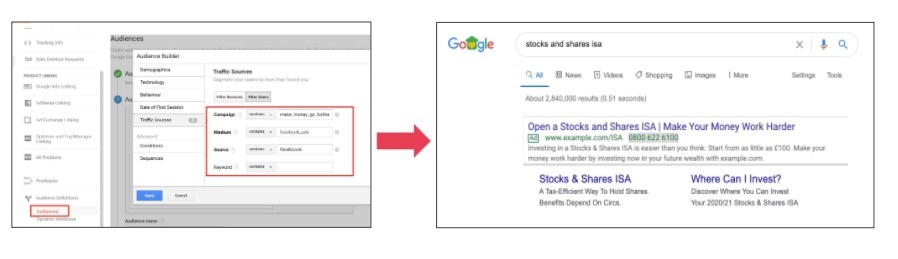

By using RLSAs, you can choose to only have your search ads shown to users who have already visited your site or performed a specific action. This means your small budget will last a lot longer than on standard search ads, because the users seeing your ads are a more qualified audience and will already be aware of your brand.

This allowed us to bid on more generic terms without sinking loads of budget into a broader audience pool. In this example, we were able to build audiences through Google Analytics based on users who’ve previously clicked on our Facebook ads, or our Quora ads, which were segmented by the UTM tags used on those campaigns, before targeting those same users when they’re searching on Google.

The great thing about this functionality is that some of the networks such as Facebook offer much more in-depth demographic targeting, and we can essentially use those same features here on Google search.

This technique always drives down CPAs (cost per action) vs. regular search ads so is certainly worth exploring. Refining your audience targeting will lower the total audience size and reduce overall volume, but is certainly an effective way of gaining a foothold in a competitive market.

Loyalty

At this stage we’re trying to maximise customer engagement and boost customer lifetime value. Not all customers are created equal – some customers will be more profitable than others and worth investing our advertising budget in for additional growth.

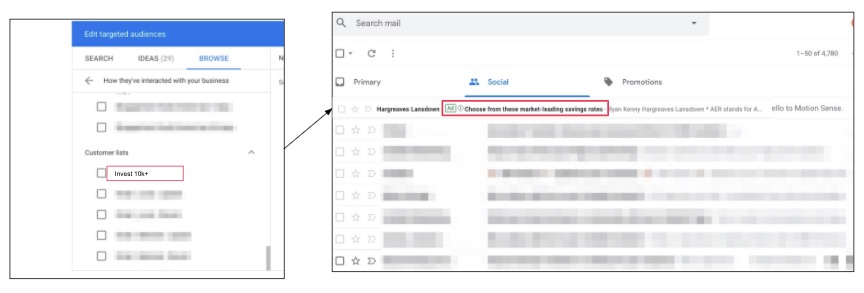

One option we’ve found useful at this stage is using Gmail sponsored promotions.

In this example, by segmenting customers who’ve invested over £10k in savings, which is seen as profitable for this client, we were able to target ads at these customers when they’re logged in to their Gmail inboxes

We can then target these users as long as there are 100 active users (website visitors) in the last 30 days – so it’s important to note that you’ll need a decent sized audience list to begin with to achieve this – we’ll come on to discuss minimum thresholds for retargeting lists later in this post.

Expansion

Finally, we’ll cover off how we can expand reach and find new customers.

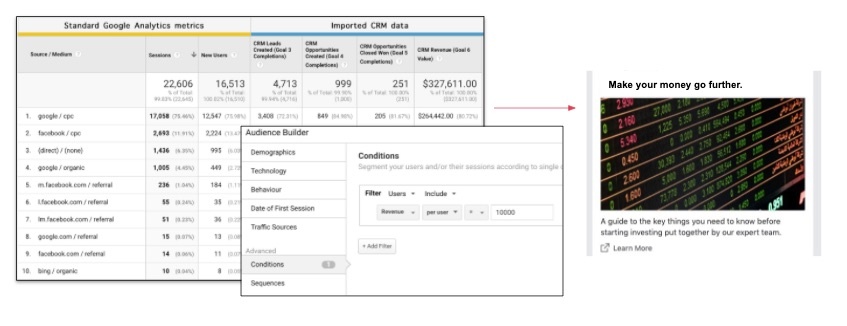

This stage relies on an important point that will involve further reading – pushing data from your CRM (post click) back to Google Analytics.

We encounter a lot of clients who are successfully tracking data from Google Analytics to major CRM systems such as Salesforce and Hubspot, but crucially NOT the other way around.

This is really important as it allows us to optimise and target campaigns based on real business performance. For example, what we could do here is define an audience list based on offline revenue.

In this case we could set conditions to filter out only those users who’ve invested over a certain amount, and use that list to then to expand and target similar audiences (lookalikes of your defined audience) via the Google display network.

There are of course other audience expansion features such as matched audiences on Linkedin and lookalike audiences on Facebook that can prove effective too, so I’d strongly recommend checking those out too as part of your targeting strategy.

A few factors to consider

We’ve referenced quite a few examples using remarketing lists during this post, so it’s important to touch on list size thresholds for eligibility.

- RLSA list size minimum of 1000 active users in a 30 day period

- Gmail retargeting list size minimum of 100 users in a 30 day period

- Similar audience seed list minimum of 100 members in a 30 day period

And when it comes to CRM integrations, if you’re looking to get your data back in to Google Analytics then I would strongly recommend checking out tools such as GAconnector and reading up on the measurement protocol.

Conclusion

The nature of campaigns is changing as we speak. Privacy is becoming a day to day concern for users, ITP and ETP will somewhat limit cookie based targeting and our campaigns may soon lose some of the trackability and data we rely on for hyper personalised targeting tactics such as some of the examples outlined in this post.

It’s perhaps now more important than ever to build a solid understanding of the audience you’re trying to target and what makes them tick. With the reduction in cookie based targeting options we may see more reliance on contextual targeting in the medium term, which means quality creative will become even more important to elicit attention from the audience you’re attempting to attract.

In summary, there’s never been a better time to rethink your approach and conduct more in-depth research to fuel your targeting strategy. While some of the targeting options will likely change over time, the frameworks needed to build an understanding of your audience will remain critical to future success.